Top enterprise tech tools you need to win as a modern CFO

Top enterprise tech tools you need to win as a modern CFO

What’s the outlook for the future of chief financial officers? As a CFO, do you believe you have the capabilities to manoeuvre your enterprise for the challenges to come?

Today, you are under more pressure than ever to provide a genuine and tangible impact to your business. You have to provide the essential context needed for good strategic organisational decisions and collaborate with the wider organisation. And while you’re doing that, you need to keep departments in line, making sure costs are constrained while opportunities are progressed. Understanding how to use enterprise tech tools is vital to achieving this.

According to research from Ernst and Young, 47% of global CFOs say their current finance function doesn’t have the right mix of capabilities to meet the demands of future strategic priorities. Meanwhile, the average CFO receives information too late to make decisions 24% of the time, according to research from the Aberdeen Group.

Finance has always been a reporting function but senior finance executives understand that today it needs to be a data-driven reporting centre, driving business initiative and strategy.

A survey by Aberdeen in 2016 called Excellence in Financial Management identified top pressures experienced by people working in financial organisations. The leading one was the corporate mandate to improve accounting and financial data quality.

Nick Castellina, research director for Aberdeen’s Business Planning and Execution practice, says: “The finance department is not only a strategic source of decision-making across organisations of all types but also a potential source of efficiencies that add to the bottom line.

“By being better able to monitor and measure more advanced performance metrics, make predictions and act quickly, CFOs can cement themselves as the key player in a business’ success.”

Big data and predictive analytics

Using analytics doesn’t mean using data for data’s sake – it means using information from all parts of the business to be a true business partner to a CEO. In accountancy, big data and analytics are particularly useful around risk management, fraud detection and commercial analysis – spotting patterns others would most likely miss.

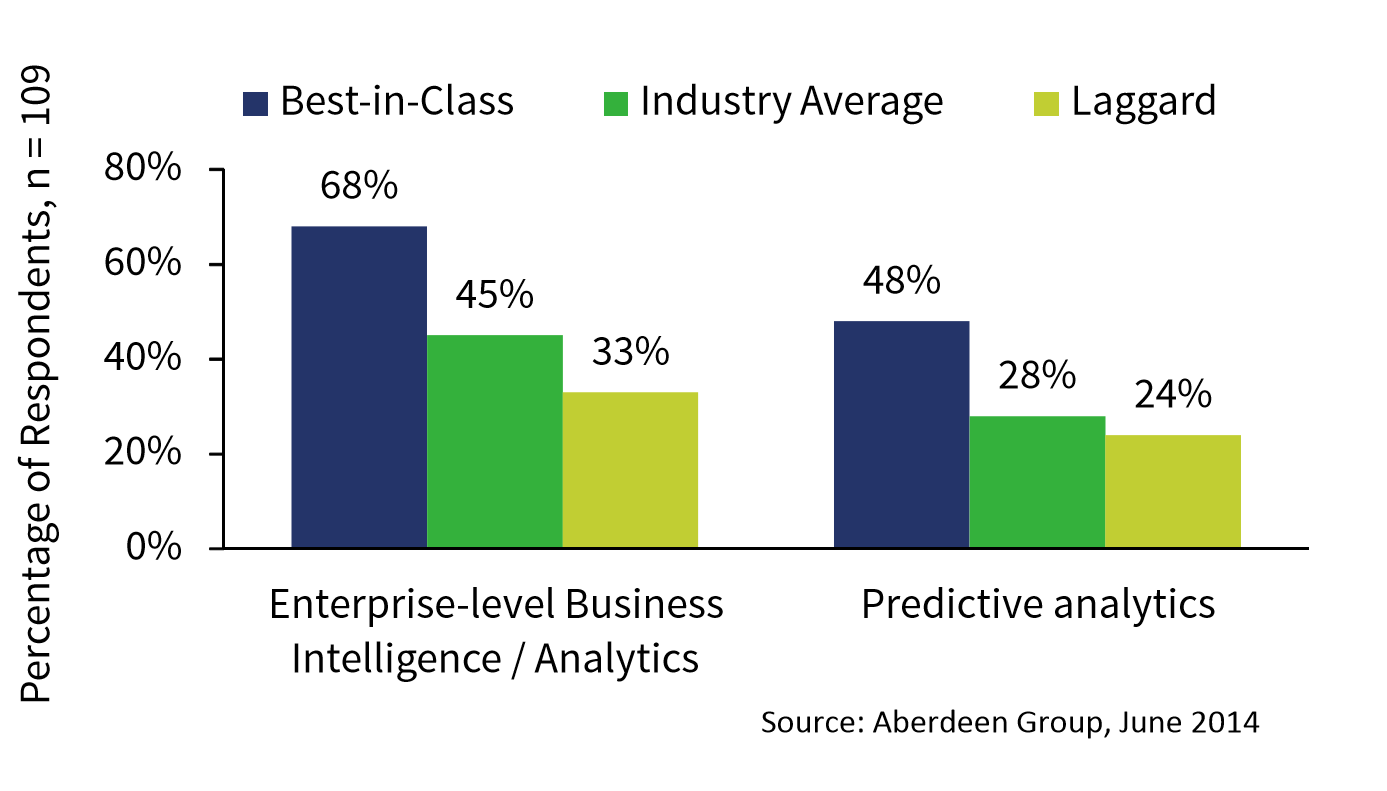

To do what your business demands, you need to look at enterprise tech solutions that offer fast and easy access to real-time financial data, while providing capabilities that allow senior finance staff to use it to make decisions. Research by Aberdeen reveals best-in-class companies are more likely to have implemented predictive analytics.

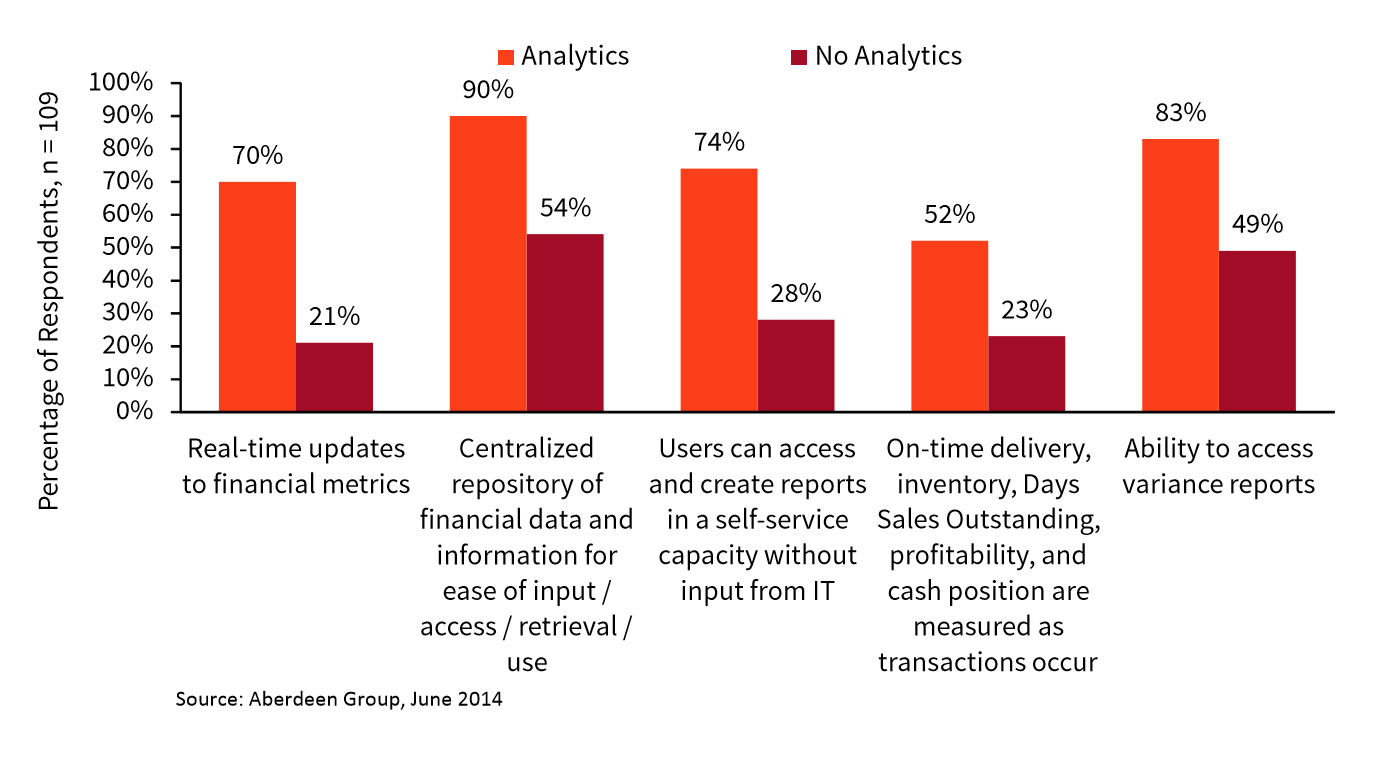

Organisations with predictive analytics are also 3.3 times more likely to have real-time updates to financial metrics.

“Being able to monitor, measure and model more financial and operational criteria will enable automated alerts that can make decision-making significantly easier and more effective. And using capabilities such as scenario analysis will take their decision-making to the next level.”

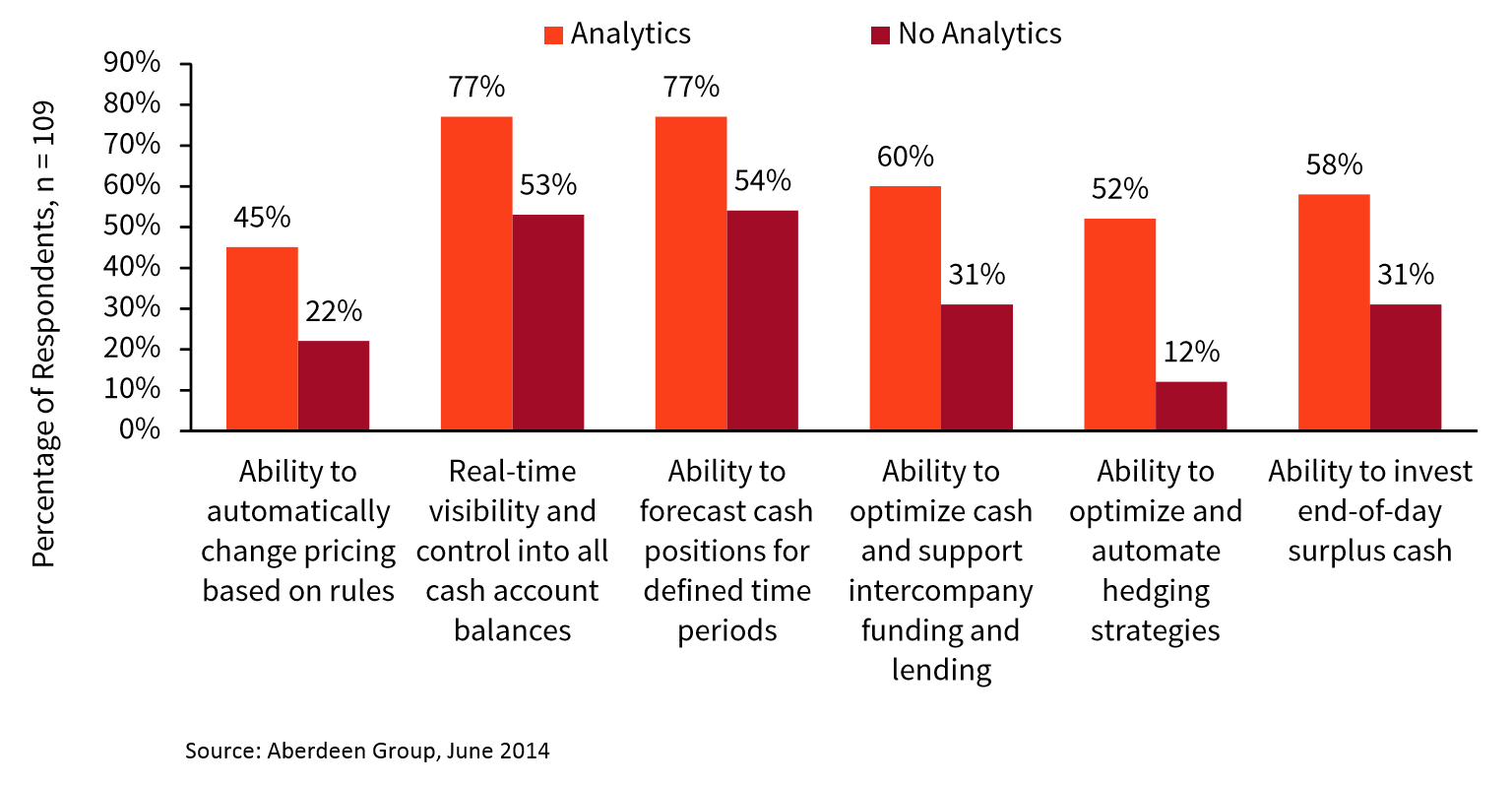

Predictive analytics can particularly benefit you and your finance department when it comes to cash management. Insight into cash balances – and the analysis of how to use that cash – is key to unlocking working capital. It will also support you in cash forecasting and improve your ability to invest working cash effectively.

Aberdeen says organisations using analytics are 4.3 times as likely to be able to optimise and automate hedging strategies, as well as 87% more likely to have the ability to invest end-of-day surplus cash.

Piers Moore-Ede, head of digital at Company Debt, says you should augment your traditional role with a knowledge of data analytics and work more closely with CIOs in general. He says: “The biggest challenge for CFOs doing this is managing the increasingly vast amounts of data and gleaning what’s important from it.

“Whatever industry you’re in, you will have to learn to see yourself as a technology company first and foremost. Those CFOs who are at the forefront of this transformation have a grasp of both data analytics and finance, meaning they are in a unique position to grasp and define corporate strategy.”

Adrian O’Connor, founding partner at Global Accounting Network, says: “The clients that we work with expect nothing less than a CFO who has a firm understanding of how big data can be harnessed to support wider organisational strategy.

“Advanced Excel is no longer enough. Like any systems or cultural shift, the biggest three components are strategy, technology and people. CFOs wishing to implement big data in their organisations need to get the mix of these three right to drive the changes home.”

Financial automation tools

Broadly speaking, automation allows you to focus on advising businesses, rather than number crunching. Adrian says: “Automated data analysis not only provides insight to help inform future business decisions but also frees up the CFO’s resources to concentrate on strategy.

“It drives down reliance on human capital and gives the board a wider set of analytics on which to base their decision making. This means one can analyse a far greater breadth of factors in coming to decisions.”

Automation that can make financial processes faster and smoother for the data-driven and technology-savvy CFO, improving the quality of data and increasing the productivity of finance and accounting staff. You should look at automation as it can:

- Minimise manual intervention in financial operations and other accounting-related tasks such as ledger entries and reconciliations.

- Auto-populate. This could involve using data from Enterprise Management and ERP systems to populate filing templates.

- Reduce the potential for human error.

- Increase and expedite turn-around.

- Improve the use of staff time through a reduction in manual process.

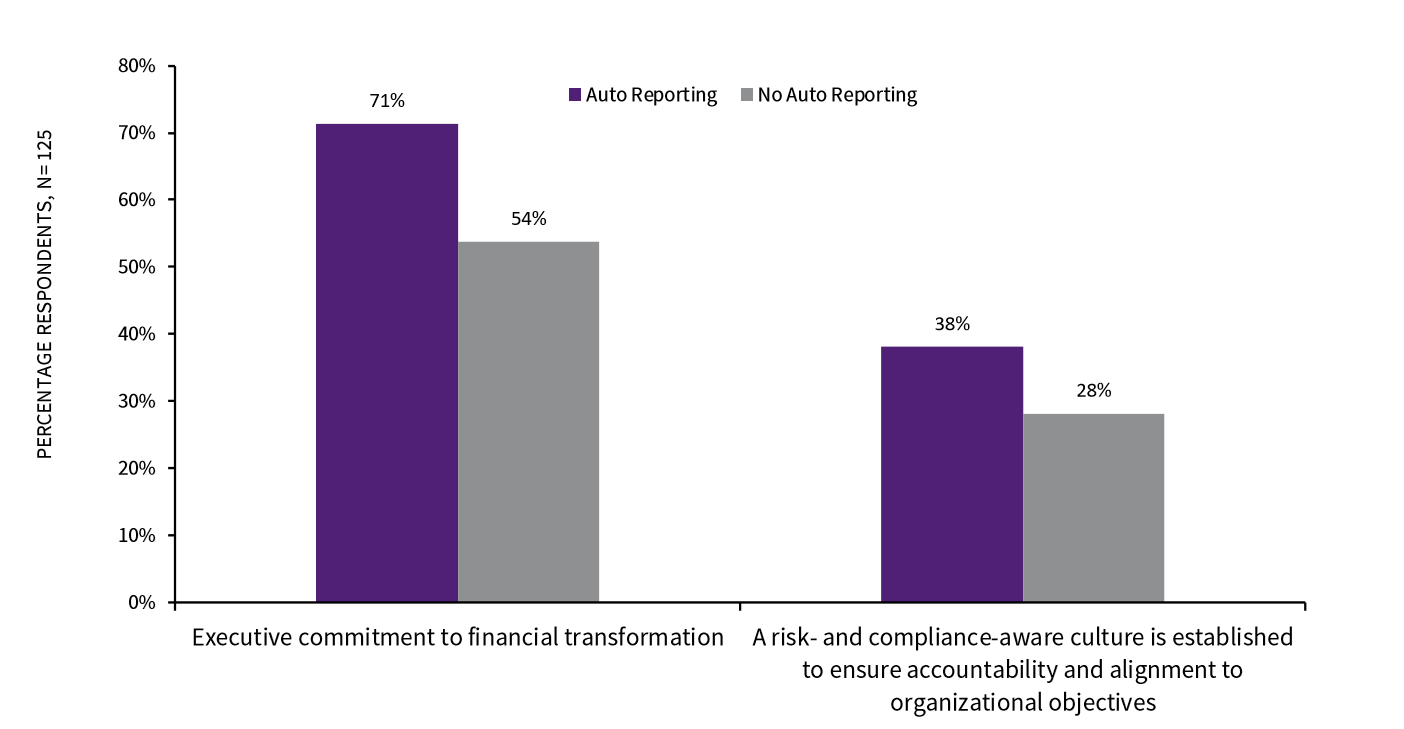

You should also understand that there’s a correlation between organisations that have committed to “improved financial transformation” and higher adoption levels of automated reporting solutions.

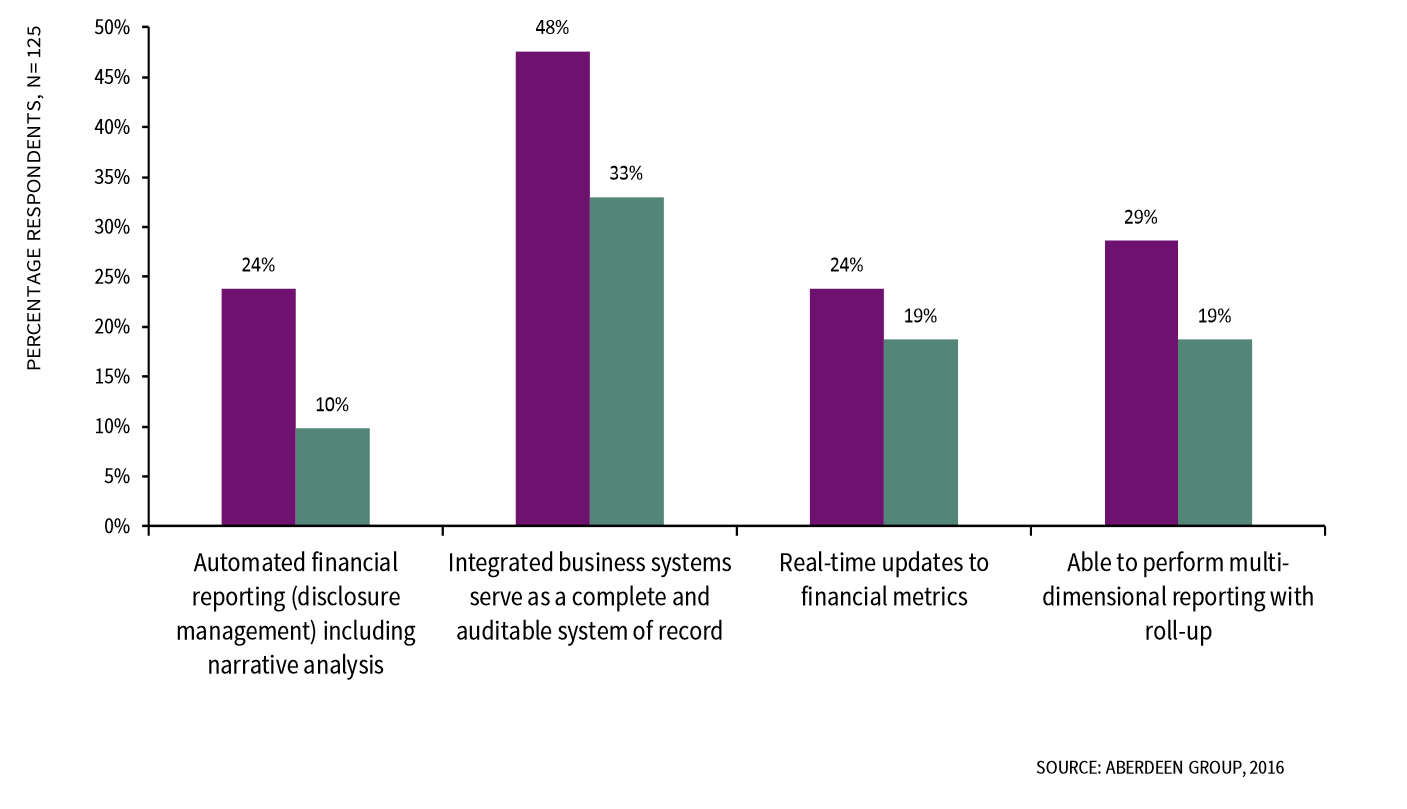

Automation and a commitment to financial transformation. Source: Aberdeen Group It’s worth considering the use of automation in your role – there are many reasons for this, including:- Automation can improve financial data by supplying it with context and a clear story. Aberdeen says users of financial reporting solutions featuring automation were 5.4 times as likely to provide narrative analysis with presented data.

- Automation allows data and analytics from various transactions to be aggregated. This is because of dimensional reporting, which allows multiple codes to be used to generate charts from compounded sets of data. Users of financial reporting with automation are 87% more likely to have the ability to perform multiple dimensional reporting.

- Real-time metrics improve the quality of related downstream data and the efficiency of prepared reports. When inputs are uploaded in real time, rather than in batches, it reduces the turnaround time needed for complete reporting and avoids gaps in financial data. Users of financial reporting with automation are 80% more likely to have real-time financial metrics.

You should take note of a figure by Aberdeen that shows the differences between “leaders” and “followers” in financial management. There is a significant overlap between leaders using solutions featuring automated reporting when it comes to key performance enhancing capabilities.

Just like the leaders do. Source: Aberdeen Group What other enterprise tech should you keep track of?

Adrian O’Connor believes you should closely watch the rise of blockchain, an emerging technology that has huge potential to impact the way finance does business. Originally developed as part of the digital currency bitcoin, it has since evolved as a viable application for key ledgers and reconciliation.At its heart, blockchain is a record of transactions that can be any movement of money, goods, assets or secure data. Many companies are at an early stage of blockchain adoption or investing in vendors working on the technology.Adrian says: “I predict that knowledge of blockchain technology will be an increasingly sought-after skill in 2018 and beyond. Senior finance professionals’ mix of business and financial nous will position them as key advisers to companies approaching these new technologies looking for opportunity.“Moving forward, the most sought-after professionals will be those who can advise on blockchain adoption and act as the bridge between digital specialists and business stakeholders.”Advanced AI technology such as machine learning has the potential to take automation a step further by removing the need for rule-based machines, instead using learning technology. Machine learning technology, for instance, could allow suggestions to be made on matching payments to invoices.Adrian believes the process element of accountancy will be increasingly emulated by technology such as artificial intelligence. However, he believes people are vital, particularly in making the best use of this type of technology.He says: “Systems are becoming increasingly automated but people are still needed to implement and manage software, update codes in line with ever-shifting legislation and analyse findings with the advantage of emotional intelligence.“Machine learning can enable robots to spot established patterns but if your organisation is on the cusp of identifying and exploiting a brand-new revenue stream, it’s likely to be a human who spots the opportunity.“Innately human skills such as creativity and rapport remain the preserve of people. While machines can crunch the numbers – often with greater efficiency due to larger sample sizes – professionals need to be in place to police systems and put the ‘human brakes’ on – particularly as self-learning systems begin to make higher level judgement calls.”Enterprise tech means more time for strategy

Adrian adds: “The rise of automation within finance has placed a fresh emphasis on the importance of innately ‘human’ skills such as creativity. And as process-led tasks are increasingly delegated to technology, senior finance professionals have the capacity to take on a larger chunk of C-suite responsibility.”This increase in responsibility is already happening. On average, five functions other than finance now report to the global CFO, according to McKinsey. More than half of CFOs say that risk, regulatory compliance, M&A transactions and execution report directly to them. Meanwhile, 38% of CFOs are responsible for IT, with some even managing cybersecurity and digitisation.McKinsey also states that, for the most part, CFOs know their role will continue to change and they will be expected to adjust the course.Besides finance, they are also having to focus on strategic leadership, organisational transformation, and performance management – 72% of CFOs said they are either significantly involved or one of the most involved executives in allocating employees and financial resources. As well as lead strategically, CFOs are expected to manage their teams to success.Expectations on what you can deliver will be constantly rising. KPMG’s View From The Top report says 63% of CEOs from high-performing organisations believe the CFOs role will increase in significance over the next three years. Adrian says: “Of course, desired skill sets depend heavily on the existing strengths of the rest of the top team – but there is no doubt that the CFO is morphing into a bigger, more challenging, role.”

Comments

Post a Comment